Online Banking Insights

Your go-to source for the latest news and trends in online finance and banking.

Lightning Fast: How Instant Crypto Transactions Are Changing the Financial Landscape

Discover how lightning-fast crypto transactions are revolutionizing finance. Don't miss the future of instant payments!

Understanding Instant Crypto Transactions: The Technology Behind the Speed

Understanding Instant Crypto Transactions is vital in today's fast-paced digital economy, where speed and efficiency can determine the success of cryptocurrency-related ventures. Traditional blockchain transactions often experience delays due to network congestion and complex verification processes. However, innovations such as Layer 2 solutions and cross-chain technology significantly enhance transaction speeds. These technologies enable users to bypass the limitations of the main blockchain by executing transactions off-chain or using alternative pathways, effectively reducing latency and making transactions virtually instantaneous.

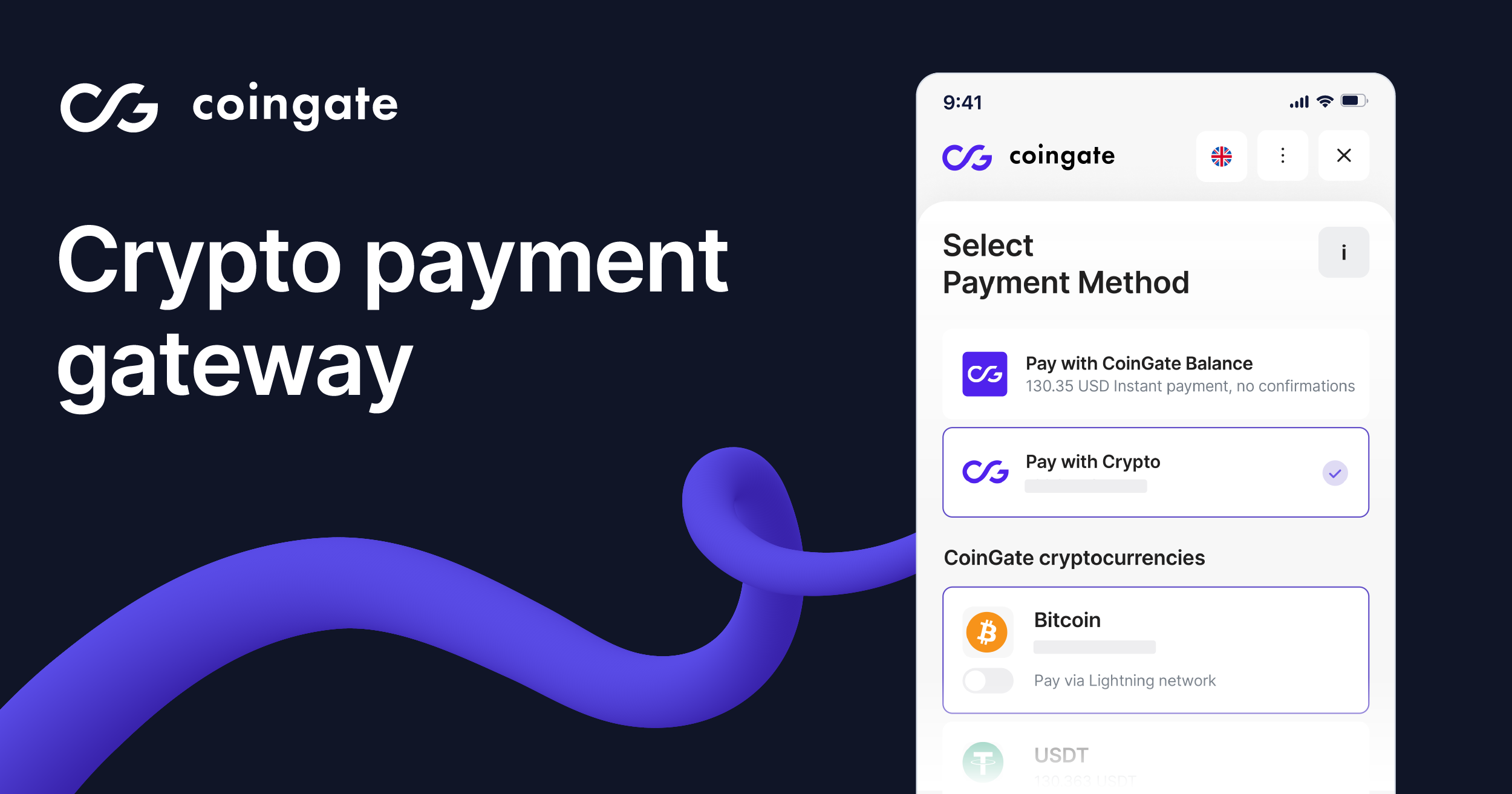

At the core of these instant crypto transactions lies the technology that allows for rapid confirmations and increased throughput. For instance, systems like the Lightning Network facilitate instant payments by creating off-chain payment channels. This technology not only accelerates transaction speed but also reduces fees, making it more viable for small and micro-transactions. By understanding how these technologies interplay, users can fully appreciate the transformative potential of instant crypto transactions, making adoption more appealing for everyday use.

Counter-Strike is a popular first-person shooter game that has captivated millions of players around the world. With its tactical gameplay and competitive nature, players must work together to complete objectives or eliminate the opposing team. For those looking to enhance their gaming experience, using a bc.game promo code can provide exciting bonuses and rewards.

The Impact of Lightning Fast Transactions on Global Commerce

The rise of lightning fast transactions is reshaping the landscape of global commerce, offering unprecedented efficiency and accessibility for consumers and businesses alike. With the advent of advanced payment technologies, including digital wallets and blockchain solutions, transactions that once took days to process can now be completed in mere seconds. This swift movement of capital not only enhances the customer experience but also provides businesses with the agility needed to adapt to market demands and capitalize on opportunities more effectively.

Moreover, the impact of lightning fast transactions extends beyond individual businesses; it fosters international trade and stimulates economic growth. Businesses can now easily engage with customers across the globe, breaking down barriers that previously hindered cross-border transactions. By facilitating instant payments, firms can reduce reliance on intermediaries and lower transaction costs, making it easier for small to medium-sized enterprises to scale and compete in the global market.

Are Instant Crypto Transactions the Future of Banking?

The advent of cryptocurrencies has sparked a revolution not only in the financial sector but also in the way we perceive banking itself. Instant crypto transactions offer numerous advantages over traditional banking methods, including lower fees, faster processing times, and increased transparency. Unlike conventional banking systems that can take days to settle transactions, blockchain technology allows for near-instantaneous transfers across the globe, eliminating the need for intermediaries. This efficiency positions instant crypto transactions as a compelling alternative, especially for businesses and consumers looking for speed and cost-effectiveness in financial transactions.

As we look toward the future, it becomes clear that instant crypto transactions could play a pivotal role in the evolution of banking. Financial institutions are increasingly exploring ways to integrate blockchain technology and digital currencies into their operations, indicating a shift towards a more decentralized financial ecosystem. With the potential for enhanced security features, reduced fraud rates, and greater financial inclusion for underserved populations, the question arises: Are instant crypto transactions the future of banking? As adoption increases, they could very well redefine how we think about money, transactions, and the banking experience as a whole.